FrankzMD

Premiumtechnical chart of Solar Industries shows several bearish signals: Weakening Momentum: The price action has shown diminishing momentum, indicating a potential loss of upward strength. This is highlighted by the flattening of the price highs in recent months. Huge Selling Volume: A sharp increase in selling volume suggests significant market pressure. The rising...

bearish technicals 🔻 1. Resistance Rejection Pivot Resistance Zone: The index has tested a major horizontal resistance (~25,950) twice (double top setup). Price Rejection: The second test is met with clear rejection and red candle, indicating supply dominance. This often marks a potential trend reversal if support zones below fail. 📉 2. MACD Bearish...

NTPC chart (as of July 12, 2025) shows strong bullish technical signals, suggesting potential upside momentum. Here's a breakdown of the bullish indicators: 🔍 1. Cup and Handle Formation Pattern: A classic bullish continuation pattern. Interpretation: Price formed a rounded bottom (cup), followed by a consolidation dip (handle), signaling accumulation before a...

embo Global Industries Ltd. is a diversified Indian enterprise engaged in manufacturing engineering products, textiles, and undertaking EPC projects. In FY2025, the company reported a significant revenue increase to ₹743.2 crore, up from ₹438.5 crore in FY2024, and a net profit of ₹40.75 crore, compared to ₹13.86 crore in the previous year . Earnings per share...

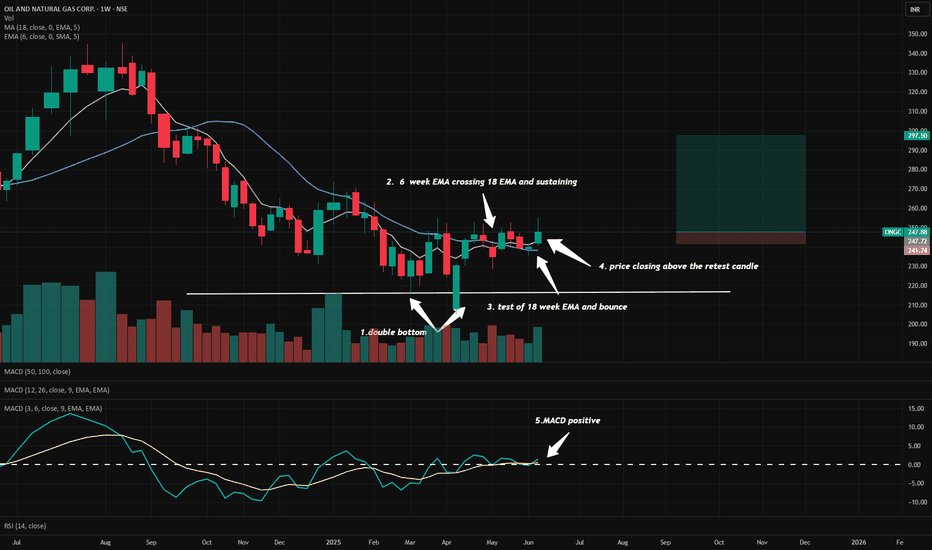

crude oil looks bullish for short term on weekly charts , 6 week EMA has crossed 18 week EMA and restested the 18 week EMA this week candle is closing above the retest candle 3-6 week MACD is positive as well Target and SL marked

price is facing resistance at 109k level with negative divergence on weekly charts, sequence of changes in events are marked target and SL marked. very low risk entry with small SL

decent valuation at current price looks good for 15 to 20 % upmove within a month have marked the techincal changes in numerical order which are self explanatory 1. higher pivot formations with successful breakouts 2.Shorter EMAs are crossing longer EMAs and continues to provide dynamic support multiple times 3.MACDs are positive target and SL marked

Best perforrming stock in Nfty 50 since 2023 technicals are showing fatigue and momentum reversal negative diveregence is observed in mothly ,weekly & daily charts sequence of events are mared SL and target and SL marked

stock is at decent valuation after a steep fall , price showing signs of bullish momentum sequence of changes in order is marked in charts Target and SL marked IGL ,Gujarat gas looks good as well

valuation is decent at current price level after falling for 8 months, price acion is showing trend reversal sequence of change is marked with numbers in chart price crossed 18 day EMA and defended it thrice on friday , price bounced from 18&50 day EMA crossing pivot level with a wite marbozu expecting 15 % run in 1 month target and SL marked

fundamentally strong , excellent durability , decent valuation stock was exceptionally strong despite the recent blood bath in street Stock is at All Time High ATH price was condolidating for nearly 10 months with a beautiful base breakout shorter EMAs are fanning out over longer EMAs target for 30 % time frame - 3 months Sl marked in charts

BSE has exceptional durability but valuation is not justified BSE has P/E arond 90 while NSE has P/E around 34 technical reasons to short on weekly charts 1. inverted pinbar violating 3 week EMA at resistance line 2.12-26 week MACD showing negative divergence ,while 3-6 week MACD has extreme techincal divergence target and Sl marked

though expensive in valuation at current level , im expecting a short bull run technicals 1. price forming an inside bar above 18 day EMA 2.inside bar like pattern is followed by a bullish engulfing bar 3.price clsoing avove 4750 (pivot level of nov 2024) target and SL marked

colpal has retraced 40 % from ATH PE is 44 still expensive but expecting a short rally from here technicals 1. 2400 level defended multiple times 2.falling wedge pattern 3.MACD showing positive divergence target and SL marked

Capital spending likley incraesing after the new government formation expecting infra related stocks to rally with this quaterly results technicals 1. price crossed above 18 day EMA and sustained 2. bullsih engulfing bar closing above 200 day EMA target and SL marked

price if facing rejection from pivot level 100-50 MACD shows window of oppurtunity 10 % profit oppurtunity low risk setup

auto sector looks weak Mahindra & Mahindra's (M&M) share price has experienced a decline recently, influenced by several factors: 1.Investment in Subsidiaries: In February 2025, M&M announced plans to invest up to ₹4,500 crore in rights issues for its subsidiaries—₹3,000 crore for Mahindra & Mahindra Financial Services Ltd. and ₹1,500 crore for Mahindra...

valuation -decent ON weekly charts , inverted head and shoulder pattern weekly close aroung 52 week high MACDs positive