Faizgazi

The Triple Bottom is a bullish reversal pattern that signals a potential shift from a downtrend to an uptrend. It’s like the market saying, “I’ve tested this support level three times, and I’m done going lower.” Here’s how it plays out: - Three Equal Lows: Price hits a support level three times, forming three distinct troughs at roughly the same level. -...

Ah, the classic Head and Shoulders—and I’m guessing you’re not talking about shampoo this time 😄 In trading, the Head and Shoulders pattern is a powerful reversal signal. It typically forms at the end of an uptrend and suggests a potential shift to a downtrend. Here's how it breaks down: - Left Shoulder: Price rises, then dips. - Head: Price rises again, reaching...

he double bottom is a classic bullish reversal pattern in technical analysis. It resembles the letter "W", forming after a downtrend when the price hits a support level twice before breaking out upwards. Key Features: - Two distinct lows at roughly the same price level. - A peak (neckline) between the two lows. - Breakout confirmation when the price moves above...

he double bottom is a classic bullish reversal pattern in technical analysis. It resembles the letter "W", forming after a downtrend when the price hits a support level twice before breaking out upwards. Key Features: - Two distinct lows at roughly the same price level. - A peak (neckline) between the two lows. - Breakout confirmation when the price moves above...

The double bottom is a classic bullish reversal pattern in technical analysis. It resembles the letter "W", forming after a downtrend when the price hits a support level twice before breaking out upwards. Key Features: - Two distinct lows at roughly the same price level. - A peak (neckline) between the two lows. - Breakout confirmation when the price moves above...

The Flag and Pole pattern is a continuation pattern in technical analysis that signals a brief consolidation before the price resumes its previous trend. It consists of two parts: - Pole – A strong price movement in one direction (either bullish or bearish). - Flag – A short consolidation phase where price moves sideways or slightly against the trend. The Head and...

It looks like you meant Fibonacci Retracement, a popular tool in technical analysis used to identify potential support and resistance levels based on the Fibonacci sequence. Traders use key retracement levels—23.6%, 38.2%, 50%, 61.8%, and 100%—to anticipate price corrections within a trend.

The Cup and Handle is a bullish continuation pattern that signals a potential breakout. It consists of two main parts: - Cup Formation: A rounded bottom resembling a "U" shape, indicating consolidation after a price decline. - Handle Formation: A slight downward drift or sideways movement, forming a small pullback before the breakout. Key Characteristics: -...

The double bottom is a classic bullish reversal pattern in technical analysis. It resembles the letter "W", forming after a downtrend when the price hits a support level twice before breaking out upwards. Key Features: - Two distinct lows at roughly the same price level. - A peak (neckline) between the two lows. - Breakout confirmation when the price moves above...

A triangle breakout is a key technical pattern in trading that signals a potential continuation or reversal of a trend. It occurs when price action breaks out of a triangle formation, which can be ascending, descending, or symmetrical. - Ascending Triangle: Bullish pattern where price breaks above resistance. - Descending Triangle: Bearish pattern where price...

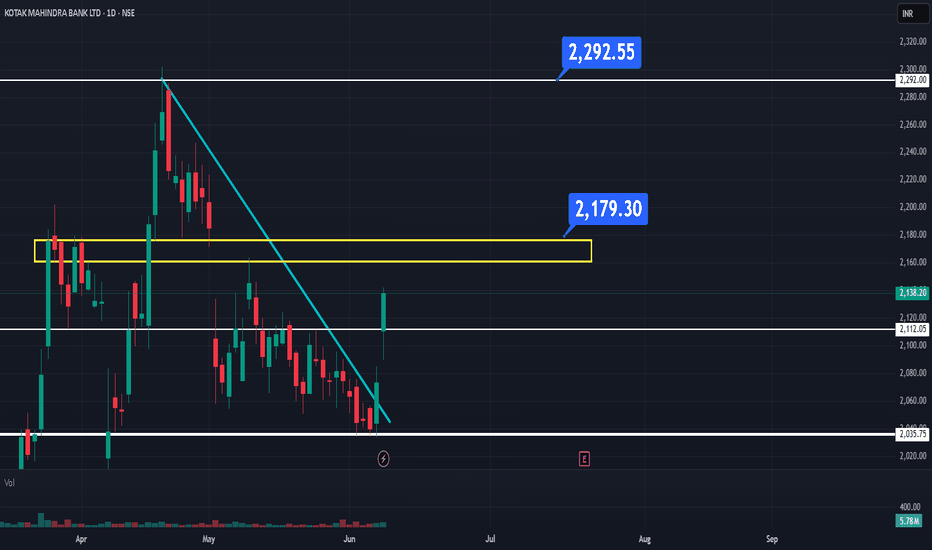

A trendline breakout occurs when price moves beyond a well-defined trendline, signaling a potential shift in market direction. It can be bullish (price breaks above a downward trendline) or bearish (price breaks below an upward trendline). Key aspects to consider: - Volume Confirmation: A breakout with strong volume is more reliable. - Retest of Trendline: Price...

The double bottom is a classic bullish reversal pattern in technical analysis. It resembles the letter "W", forming after a downtrend when the price hits a support level twice before breaking out upwards. Key Features: - Two distinct lows at roughly the same price level. - A peak (neckline) between the two lows. - Breakout confirmation when the price moves above...

The double bottom is a classic bullish reversal pattern in technical analysis. It resembles the letter "W", forming after a downtrend when the price hits a support level twice before breaking out upwards. Key Features: - Two distinct lows at roughly the same price level. - A peak (neckline) between the two lows. - Breakout confirmation when the price moves above...

A triangle breakout is a key technical pattern in trading that signals a potential continuation or reversal of a trend. It occurs when price action breaks out of a triangle formation, which can be ascending, descending, or symmetrical. - Ascending Triangle: Bullish pattern where price breaks above resistance. - Descending Triangle: Bearish pattern where price...

The double bottom is a classic bullish reversal pattern in technical analysis. It resembles the letter "W", forming after a downtrend when the price hits a support level twice before breaking out upwards. Key Features: - Two distinct lows at roughly the same price level. - A peak (neckline) between the two lows. - Breakout confirmation when the price moves above...

A triangle chart pattern is a tool used in technical analysis. Named for its resemblance to a series of triangles, the triangle chart pattern is created by drawing trendlines along a converging price range. The result signals a pause in the prevailing trend. Technical analysts read the triangle as an indicator of a continuation of an existing trend or...

A triangle chart pattern is a tool used in technical analysis. Named for its resemblance to a series of triangles, the triangle chart pattern is created by drawing trendlines along a converging price range. The result signals a pause in the prevailing trend. Technical analysts read the triangle as an indicator of a continuation of an existing trend or...

A double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. It describes the drop of a security or index, a rebound, another drop to the same or similar level as the original drop, and finally another rebound (that may become a new uptrend). The...