BANKNIFTY - Trading levels and Plan for 18-Jul-2025📊 BANK NIFTY INTRADAY TRADING PLAN – 18-Jul-2025

Gap Opening Reference: 200+ Points Considered Significant

📍 IMPORTANT LEVELS TO MONITOR

🟥 Last Intraday Resistance Zone: 57,400 – 57,447

🟧 Opening Resistance: 56,936

🟩 Opening Support Zone: 56,667 – 56,605

🟢 Last Intraday Support (Buyer’s Zone): 56,331 – 56,430

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,136) 📈

(Gap opening considered above 200+ points from the previous close)

If Bank Nifty opens above 57,136 , strength is expected toward Last Intraday Resistance Zone: 57,400 – 57,447 .

Avoid buying immediately after the opening candle; allow 15–30 minutes for price confirmation and volatility settlement.

If price sustains above 57,400 , upside momentum may continue, but consider trailing your stop-loss as this is an exhaustion zone.

Options Tip: Consider ATM or slightly OTM Call Options or Bull Call Spread setups for controlled risk.

📊 SCENARIO 2: FLAT OPENING (Between 56,667 – 56,936) ⚖️

This range marks the equilibrium between buyers and sellers, as defined by Opening Support Zone and Opening Resistance .

Observe the first 15–30 minute candle for clear direction.

If price sustains above 56,936 , bias turns bullish toward 57,400 – 57,447 .

If price breaks below 56,667 , sellers may push Bank Nifty toward Buyer’s Zone: 56,331 – 56,430 .

Options Tip: Employ Strangle or Iron Fly strategies around flat openings with tight ranges.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,467) ⚠️

If Bank Nifty opens below 56,467 , downside momentum may accelerate toward Last Intraday Support: 56,331 – 56,430 .

Avoid instant selling at open. Let first 15–30 minute candle give direction clarity.

If price sustains below 56,331 , weakness could extend further.

Options Tip: Focus on ATM or ITM Put Options , or Bear Put Spreads for safer downside positioning.

💡 OPTIONS TRADING RISK MANAGEMENT TIPS

📏 Risk no more than 1–2% of your capital on any single trade.

⏳ Give at least 15–30 minutes after market open before initiating trades.

🔐 Use Hourly Close-based Stop Losses to avoid getting trapped by wicks.

⚖️ Prefer hedged strategies ( Spreads, Iron Fly, Strangles ) during high IV (Implied Volatility) phases.

🚫 Avoid revenge trading. Accept stop-loss gracefully; focus on next setup.

📌 SUMMARY & CONCLUSION

Bullish Bias: Gap-up above 57,136 → Focus on 57,400–57,447 zone.

Range-bound Bias: Flat between 56,667–56,936 → Watch for breakout confirmation.

Bearish Bias: Gap-down below 56,467 → Eye on 56,331–56,430 support zone.

Prioritize confirmation from 15–30 minute opening range before acting.

Maintain strict risk management discipline using options tools like spreads.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is shared strictly for educational and informational purposes. Please consult your financial advisor before making any trading or investment decisions.

Bankniftytradesetup

BANKNIFTY MATHEMATICAL LEVELSThese Levels are based on purely mathematical calculations.

How to use these levels :-

* Mark these levels on your chart.

* Safe players Can use 15 min Time Frame

* Risky Traders Can use 5 min. Time Frame

* When Candle give Breakout / Breakdown to any level we have to enter with High/Low of that breaking candle.

* Targets will be another level marked on chart

* Stop Loss will be Low/High of that Breaking Candle.

* Trail your SL with every candle.

* Avoid Big Candles as SL will be high then.

* This is one of the Best Risk Reward Setup.

For Educational purpose only

FMCG & ConsumptionThink about your daily life — the toothpaste you use, the biscuits you eat, the shampoo you prefer, the tea you drink, the food delivery app you order from. Every one of these touches a part of the FMCG & consumption sector.

Now multiply that by 1.4 billion Indians, and you realize the size of this engine.

In 2025, the FMCG (Fast-Moving Consumer Goods) and consumption-driven stocks are at the center of a powerful story — one shaped by:

India's rising middle class

Rural income revival

Urban premiumization

Growth of e-commerce and quick commerce

Digital payments & new-age D2C (Direct-to-Consumer) brands

This isn't just a theme — it's a structural growth trend that never goes out of fashion.

Let’s break it down step-by-step.

🧼 What is FMCG & Consumption Sector?

FMCG stands for Fast-Moving Consumer Goods. These are everyday products people buy frequently:

Food & beverages (biscuits, noodles, soft drinks, snacks)

Personal care (soap, shampoo, deodorant)

Household items (detergent, floor cleaner, toothpaste)

Over-the-counter (OTC) products (balms, cough syrup, nutrition)

The Consumption theme expands on this to include:

Retail (organized & unorganized)

Quick commerce (Blinkit, Zepto)

E-commerce (Amazon, Flipkart, Nykaa)

Food delivery (Zomato, Swiggy)

Apparel & footwear (Trent, Aditya Birla Fashion)

Durables & electronics (TVs, fridges, fans, phones)

So whether it’s Maggi or Myntra, Parle-G or Paytm Mall — it all fits under Consumption.

🔥 Why FMCG & Consumption Is Trending in 2025

Let’s look at what’s driving this sector today:

1️⃣ Rural Demand Is Rebounding

After 2 years of low rural growth due to inflation and erratic monsoons, 2025 has brought strong crop output, stable agri prices, and more cash in hand.

Rural India forms over 40% of FMCG consumption, especially:

Entry-level soaps, snacks, tea

Sachet products

Local brands

Companies like Dabur, HUL, Marico, and Emami have all confirmed rural growth is picking up fast.

2️⃣ Premium Urban Consumption Is Booming

At the same time, India’s cities are upgrading:

Tier-2 cities now demand premium face creams, health foods, organic juices

Young consumers are choosing branded wear, subscription boxes, and gourmet snacks

Working women are driving personal care product sales

Urban India is moving from price to value, and that’s a goldmine for consumer brands.

3️⃣ Quick Commerce Is Changing Habits

Apps like Blinkit, Zepto, Swiggy Instamart are:

Delivering goods in 10–20 minutes

Creating new demand cycles (midnight snacking, impulse buys)

Becoming a new channel for FMCG sales

For FMCG companies, this means higher turnover and visibility, especially for smaller SKUs (sachets, ₹5/₹10 packs).

4️⃣ Direct-to-Consumer (D2C) Boom

New-age startups like:

Mamaearth (beauty, baby care)

WOW Skin Science (natural shampoos)

BoAt (audio & smart accessories)

Licious (fresh meats)

…are bypassing traditional stores and selling directly online.

This model:

Cuts middlemen

Boosts margins

Creates brand intimacy

And now many of these brands are listed or IPO-ready, adding fire to the consumption story.

5️⃣ China+1 & Make in India Push

Many global companies now manufacture in India, not China:

Personal care

Cosmetics

Packaged foods

This reduces costs, improves supply chains, and boosts exports of Indian FMCG brands too.

📈 Stock Market Performance (2023–2025)

Let’s take a look at how some top names have performed:

Stock Jan 2023 Price July 2025 Price Return

ITC ₹340 ₹460+ 35%

Hindustan Unilever ₹2,500 ₹2,800+ 12%

Dabur ₹550 ₹675+ 22%

Nestle India ₹18,000 ₹24,000+ 33%

Zomato ₹55 ₹195+ 250%+

Nykaa ₹120 ₹180+ 50%

Mamaearth (Honasa) ₹320 (IPO) ₹460+ 44%

Quick commerce, D2C and food delivery stocks have been top gainers.

Traditional FMCG majors are more slow & steady compounders.

🛒 Segments Inside FMCG & Consumption

Let’s divide this into sub-themes:

🍪 1. Packaged Foods & Beverages

Britannia (biscuits)

Nestle India (Maggi, chocolates)

Tata Consumer (tea, coffee, salt)

Varun Beverages (Pepsi bottling)

Bikaji, Prataap Snacks (local snacks)

🧼 2. Personal & Household Care

HUL (Dove, Surf Excel, Lifebuoy)

Dabur (Chyawanprash, Vatika)

Marico (Parachute, Saffola)

Godrej Consumer (Goodknight, Cinthol)

Emami (Fair & Handsome, Navratna)

🛍️ 3. Retail Chains & Apparel

Trent (Westside, Zudio)

V-Mart

Avenue Supermarts (D-Mart)

Aditya Birla Fashion (Pantaloons, Van Heusen)

Shoppers Stop

🍕 4. Online Food & Quick Commerce

Zomato

Jubilant Food (Domino’s)

Devyani International (KFC, Pizza Hut)

Zepto (IPO coming soon)

Blinkit (part of Zomato)

💄 5. Beauty & D2C Personal Care

Honasa (Mamaearth)

Nykaa

Lotus Herbals (Private)

WOW Skin Science (IPO Expected)

💡 Why Traders and Investors Love This Sector

✅ Always in Demand – Recession or boom, people still need soap and toothpaste.

✅ Strong Brand Power – Consumer loyalty = pricing power = margin stability.

✅ Low Capex Businesses – High return on capital, especially for asset-light D2C models.

✅ Growth via Premiumization – Indians are trading up from "cheap" to "value".

✅ Earnings Predictability – FMCG companies often beat or meet earnings estimates.

📊 How to Trade or Invest in This Theme

🎯 For Long-Term Investors:

Pick 3–4 companies across segments:

One traditional FMCG major (HUL, ITC)

One high-growth food player (Nestle, Varun Beverages)

One retail/delivery stock (Zomato, Trent)

One new-age D2C story (Mamaearth, Nykaa)

Hold for 3–5 years. These stocks are slow compounders with low risk + decent reward.

📉 For Traders:

Look for volume breakouts after consolidation

Track monthly updates on rural/urban growth

Trade around quarterly results and guidance

Use options strategy around earnings for volatility plays (like Zomato)

⚠️ Risks to Watch Out For

Risk Explanation

Inflation Pressure Higher input costs (milk, palm oil) hurt margins

Valuation Concerns Some D2C stocks may be overpriced

Competition from Local Players Especially in rural and Tier-3 cities

Dependency on Monsoon A weak monsoon can dent rural demand

🚀 The Road Ahead (2025–2030)

India is expected to:

Add 250 million middle-class consumers by 2030

See online retail double in size

Witness over 500 million people shop on mobile phones

Grow FMCG exports to Asia & Africa

The Indian consumption engine is just starting up. This isn't a temporary trend — it’s a secular, multi-decade opportunity.

✅ Conclusion

The FMCG & consumption story in India is:

Stable during slowdowns

Explosive during booms

Universal in reach — touching every home, city, and village

Now evolving rapidly with D2C, quick commerce, and premiumization

Whether you're an investor looking for consistent compounding or a trader looking for smart momentum plays, this is one of the most powerful sectors to focus on in 2025 and beyond

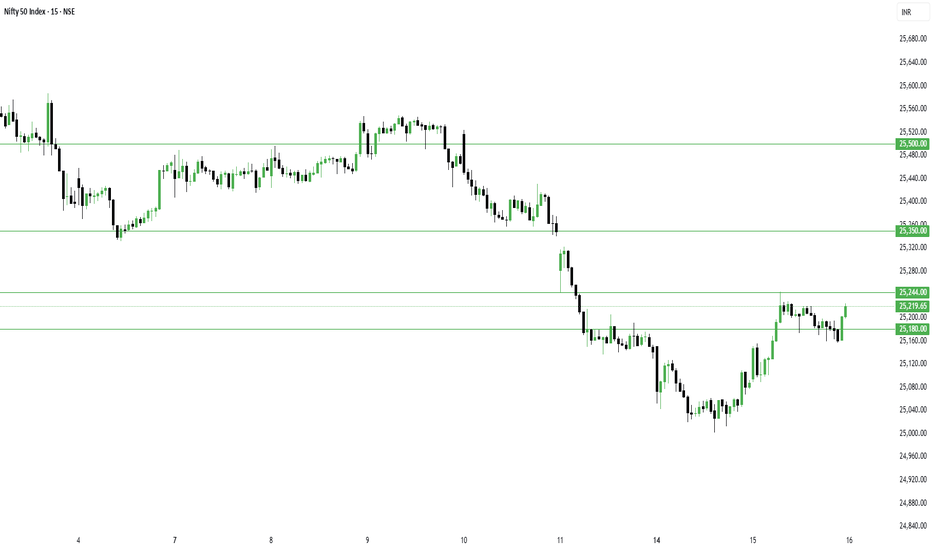

Nifty Holds Positive Trend, BankNifty Eyes New High - Key LevelsThe missing piece we talked about yesterday — a close above 25200 — is now complete.

Selling pressure has reduced, although we didn’t get the strong follow-up buying we expected.

But from a trading perspective, today was superb:

- NSE:SPORTKING , which we bought yesterday, gained another 7% today.

- NSE:EDELWEISS intraday setup delivered a solid 6% move.

- NSE:TATAPOWER ATM options shot up by 100%.

- As mentioned in yesterday’s commentary, NSE:CNXPSUBANK performed well — I’m holding NSE:BANKBARODA and had added #SBIN a few days back.

- NSE:SHYAMMETL closed strong today; I’ve taken it as a positional trade.

- I exited NSE:CUPID today and replaced it with $NSE:MOBIKWIK.

In total, I’m holding 4 open positions, and I’ll continue to hold them until they overextend.

Coming to the market:

Nifty formed a Supply Candle today as sellers’ volume was 33 million higher than buyers.

The positive takeaway is that selling pressure has eased, and the trend has moved back to the positive zone.

Considering these conditions, tomorrow is likely to remain sideways.

NSE:NIFTY levels for tomorrow:

- Resistance: 25250 — a close above this could trigger short covering up to 25500

- Support: 25155

BankNifty looks stronger than Nifty and seems ready for a new all-time high.

NSE:BANKNIFTY levels for tomorrow:

- Support: 57000

- Resistance: 57300 — a breakout above this can push it to fresh highs

Sector-wise, #PSUBANKS remained the strongest today.

That’s all for today.

Take care.

Have a profitable tomorrow.

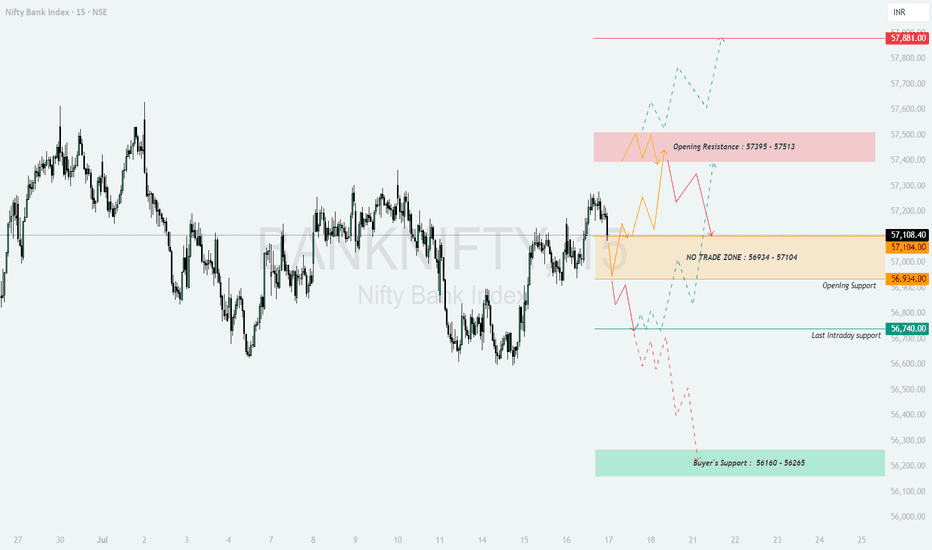

BANKNIFTY : Intraday Trading levels and Plan for 17-July-2025📊 BANK NIFTY INTRADAY TRADING PLAN – 17-Jul-2025

200+ Points Gap Opening Considered Significant | Structured by Psychological Zones

📍 KEY ZONES AND LEVELS TO MONITOR:

🟥 Opening Resistance Zone: 57,395 – 57,513

🔴 Profit Booking Resistance: 57,881

🟧 NO TRADE ZONE: 56,934 – 57,104

🟦 Opening Support: 56,934

🟩 Last Intraday Support: 56,740

🟩 Buyer’s Support Zone: 56,160 – 56,265

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,395) 📈

If BANK NIFTY opens above 57,395 with 200+ points gap-up, the market enters the Opening Resistance Zone (57,395 – 57,513) .

Buyers should be cautious within this zone, focusing only on quick momentum scalps until a 15-minute candle closes above 57,513 .

If 57,513 breaks and sustains, the next target would be 57,881 (Profit Booking Resistance) .

Options Tip: Deploy ATM Call Options with small quantity initially, increase exposure only on candle confirmation. Avoid far OTM calls in strong gap-ups.

📊 SCENARIO 2: FLAT OPENING (Between 56,934 – 57,104) ⚖️

This zone is marked as NO TRADE ZONE on the chart. Prices may behave indecisively here, so patience is key.

If BANK NIFTY sustains above 57,104 after opening flat, expect upside continuation toward the Opening Resistance Zone.

If BANK NIFTY breaks below 56,934 , look for weakness targeting Last Intraday Support 56,740 .

Options Tip: Consider Iron Condor or Strangle Writing setups within this NO TRADE ZONE if volatility is high. Otherwise, wait for breakout confirmation.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,740) ⚠️

If BANK NIFTY opens below 56,740 with a significant gap, bearish momentum is confirmed.

The immediate downside target would be the Buyer’s Support Zone: 56,160 – 56,265 .

Sell-on-rise strategy can be considered after the first 15-minute candle closes below 56,740 .

Options Tip: Prefer ATM or ITM Put Options or build Bear Put Spreads for controlled risk-reward. Avoid naked shorts in case of sudden reversal.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📏 Risk only 1–2% of capital per trade.

⏳ Avoid aggressive entries in the first 15–30 minutes ; let price settle.

🔐 Use Hourly Candle Close for major decision stops, not just wick-based SL.

⚖️ Consider Hedged Strategies (like spreads) during volatile conditions.

📅 Avoid trading just before major news events or expiry if possible.

📌 SUMMARY & CONCLUSION

Bullish Scenario: Gap-up above 57,395 → Target 57,881

Neutral Scenario: Flat between 56,934 – 57,104 → Wait for breakout confirmation

Bearish Scenario: Gap-down below 56,740 → Target 56,160 – 56,265

Trade cautiously around marked zones and follow structured rules. Consistency over prediction!

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This plan is shared for educational and informational purposes only. Please consult your financial advisor before making any investment decisions.

Technical Class✅ What You Learn in a Technical Class

1. Introduction to Technical Analysis

What is price action?

Difference between Technical and Fundamental Analysis

Basics of Candlestick Charts

2. Candlestick Patterns

Bullish and Bearish Patterns

Reversal Patterns (Doji, Hammer, Shooting Star)

Continuation Patterns (Flags, Pennants)

3. Chart Patterns

Double Top, Double Bottom

Head and Shoulders

Triangles (Ascending, Descending)

4. Indicators and Oscillators

Moving Averages (MA, EMA)

RSI (Relative Strength Index)

MACD (Moving Average Convergence Divergence)

Bollinger Bands

5. Support and Resistance

How to Identify Strong Support Zones

How to Use Resistance Levels for Entries/Exits

6. Trend Analysis

How to Spot a Trend (Uptrend, Downtrend, Sideways)

Trendlines and Channels

Breakouts and Fakeouts

7. Volume Analysis

Importance of Volume in Confirming Moves

Volume Spikes and Market Reversals

8. Risk Management

How to Protect Your Capital

Stop Loss and Take Profit Strategies

Risk-Reward Ratio

✅ Who Should Attend a Technical Class?

✅ Stock Market Beginners

✅ Intraday Traders

✅ Swing Traders

✅ Option Traders

✅ Anyone who wants practical market knowledge

BANK NIFTY view for 16-07-202557193-57213 will act as a crucial resistance followed by there is an upper TL and Broadening top formation.

If it breaks above TL highs will be the targets.

If it takes resistance as mentioned it will reach support level 56600. Once it breaks and closes below 56550 in lower TF we can expect huge downside.

BANKNIFTY : Trading levels and plan for 16-July-2025📊 BANK NIFTY INTRADAY TRADING PLAN – 16-Jul-2025

Based on 15-Min Chart Observation | 200+ Point Gap Considered Significant

📍 IMPORTANT LEVELS TO WATCH

🟥 Resistance Zone: 57,404 – 57,511

⚫️ Opening Resistance / Support: 57,164

🟧 Opening Support Zone: 56,932 – 56,974

🟩 Last Intraday Support: 56,711

🟩 Buyer’s Support Zone: 56,337 – 56,466

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,164) 📈

If BANK NIFTY opens above 57,164 with a gap of 200+ points, expect a continuation toward the Resistance Zone 57,404 – 57,511 .

Aggressive buying should only be considered after a 15-min candle close above 57,164 to confirm strength.

If prices enter the Resistance Zone, avoid fresh longs and look for profit booking opportunities.

Options Tip: Focus on ATM or ITM Call Options . Avoid far OTM options on gap-up days to minimize theta loss.

📊 SCENARIO 2: FLAT OPENING (Between 56,932 – 57,164) 🔄

This range is marked as a mixed zone: Opening Resistance / Support Zone . Price behavior here will set the day’s tone.

If BANK NIFTY sustains above 57,164 , move towards the bullish setup targeting the upper Resistance Zone.

If BANK NIFTY breaks below 56,932 , expect a decline toward Last Intraday Support 56,711 .

Options Tip: Consider Straddle or Strangle setups for premium decay if prices stay sideways between 56,932 – 57,164. Exit quickly if volatility spikes.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,711) ⚠️

A gap-down below 56,711 signals bearish momentum. Initial downside target would be the Buyer’s Support Zone: 56,337 – 56,466 .

Wait for the first 15-minute candle close below 56,711 before shorting to confirm strength.

If prices bounce from Buyer’s Support Zone , observe for reversal signals and manage trailing stop-loss.

Options Tip: Favor ATM or ITM Put Options . On gap-downs, avoid naked far OTM positions—use Bear Put Spreads for balanced risk-reward.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📏 Risk only 1–2% of your trading capital per trade.

⏳ Avoid impulsive entries in the first 15–30 minutes of market opening.

⚖️ Always mark your Stop-Loss based on candle close, not just price spikes.

📈 Choose ATM or ITM options —they offer better Delta and lesser time decay.

💼 Reduce position size when markets open with large gaps to avoid slippage risks.

📌 SUMMARY & CONCLUSION

Bullish Scenario: Above 57,164 → Target 57,404 – 57,511

Range-Bound Scenario: Between 56,932 – 57,164 → Watch closely for breakouts

Bearish Scenario: Below 56,711 → Target 56,337 – 56,466

Stay disciplined and patient. Let the market come to your planned levels instead of chasing moves.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please do your own research or consult a certified financial advisor before making trading decisions.

Pivot Low Formed, Follow-Up Buying Crucial – Nifty and BankniftyYesterday, i mentioned that sellers’ volume was 40 million higher than buyers, and for a new trend to emerge, today’s candle needed to absorb that supply.

And look what happened — today, buyers’ volume surpassed sellers’ by 82 million.

All the setups I traded today blasted exactly as expected:

NSE:SWARAJENG (Earnings Pivot) – +10%

NSE:SPORTKING – +5.92%

NSE:MOBIKWIK – +4.16%

For the short term, I am still holding NSE:CUPID , which has already given a 22% move in the last 3 sessions since my entry!

Now, coming to today’s market action:

NSE:NIFTY formed a Demand Candle today, and along with that, a Pivot Low has also been created.

The only missing piece is that the index hasn’t yet closed above 25200.

The message is clear — if we get follow-up buying tomorrow, the index could be ready for a fresh high.

For tomorrow:

Resistance: 25244 — once crossed, short covering can push it directly to 25350/25500.

Support: will be at 25180.

NSE:BANKNIFTY looks more positive, and this time, NSE:CNXPSUBANK could be the key driver.

For BankNifty:

- Support: 56965

- Resistance: 57260 — a close above this could trigger a move towards a new high.

Talking about sector rotation — in the short-term timeframe, a new sector has emerged: NSE:NIFTY_CONSR_DURBL

NSE:NIFTY_IPO stocks remain strong, and for intraday trades, NSE:CNXAUTO and NSE:NIFTY_EV stocks are at the top of the list. So if you’re planning tomorrow’s intraday trades, focus on these sectors.

That’s all for today.

Take care.

Have a profitable tomorrow.

BANKNIFTY TRADING PLAN – 15-JUL-2025📊 BANK NIFTY TRADING PLAN – 15-JUL-2025

Educational write-up based on key technical levels, considering all opening scenarios with a 200+ points gap threshold

💡 Previous Close: 56,763.60

⏱️ Candle Time Frame: 15-Min Chart

⚠️ Important Note: Allow the first 15–30 minutes to observe price action before committing capital.

Gap Opening Consideration: 200+ points

📌 KEY LEVELS TO WATCH

🟥 Resistance Zone: 57,410

🟥 Last Intraday Resistance: 57,160

🟧 Opening Resistance/Support Zone: 56,932 – 56,974

🟨 Opening Support: 56,629

🟩 Buyer's Zone (Best Buy Area): 56,328 – 56,427

🔴 Extreme Support Zone: 56,139

🚀 SCENARIO 1: GAP-UP OPENING (Above 56,932) 📈

If Bank Nifty opens above 56,932 with strength, immediate upside targets become 57,160 followed by 57,410 .

Do not jump in directly on a gap-up; wait for confirmation via price sustaining above the first 15-minute candle.

Failure to sustain above 56,932 can trigger profit booking. Reversal shorts should be considered below 56,974 if rejection candles form.

Options Traders: Prefer buying ATM/ITM CE options on strength with tight stop-loss. Avoid far OTM as theta burn is higher post gap-up.

📊 SCENARIO 2: FLAT OPENING (Between 56,629 – 56,932) 🔄

Flat opening in this range signals indecision. Observe whether price holds above or below Opening Support 56,629 .

If Bank Nifty sustains above 56,932 after a flat open, momentum can push towards 57,160.

Break below 56,629 increases downside risk. Expect drift towards the Buyer's Zone 56,328 – 56,427 .

Options Traders: Avoid directional trades in the first 15 minutes. Once structure is clear, use ATM strikes for better premium decay protection.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,429) ⚠️

If Bank Nifty opens below 56,429 , immediate attention should be on the Buyer's Zone 56,328 – 56,427 .

This is a key bounce zone. If the zone holds, look for reversal trades; if broken, next possible support lies around 56,139 .

Avoid aggressive puts right at open post-gap-down. Wait for retests and price rejection confirmation before entering.

Options Traders: IV spikes are common post-gap-down. Focus on hedged positions or spreads to avoid overpaying for premiums.

💡 OPTIONS TRADING RISK MANAGEMENT TIPS

Use 1–2% capital allocation per trade.

Respect key support/resistance zones. Avoid chasing prices in emotional setups.

Stick to ATM/ITM strikes to reduce theta and volatility crush.

Be cautious post 2:30 PM – options time decay accelerates heavily.

Always trade with defined stop-loss based on 15-minute candle closes . Avoid relying solely on price ticks.

📌 SUMMARY & CONCLUSION

Bullish Trigger: Gap-up above 56,932 → Targets 57,160 – 57,410.

Neutral Zone: 56,629 – 56,932 → Observe first 15–30 minutes for clarity.

Bearish Trigger: Gap-down below 56,429 → Watch 56,328 – 56,139.

Stay patient. The market often gives second chances even if you miss the first move.

Options premium management and risk control are more important than chasing every move.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is shared for educational and learning purposes only. Please conduct your own research or consult with a financial advisor before making any trading decisions.

July is Historically a Bullish Month for NiftySaid earlier that NSE:NIFTY could pull back till 25000 and then bounce. And that's exactly what happened.

The quarterly rotation in the market seems to have completed. And today, supply started getting absorbed.

I’ve already mentioned before — July has historically been a positive month for the markets, and that view still stands.

The outlook remains bullish.

Today’s candle in Nifty is a demand candle — it has absorbed nearly half of the selling pressure.

However, the remaining supply is still there, since sellers outnumbered buyers by around 40 million today.

So we’ll turn aggressive only if tomorrow’s early session absorbs this supply.

Ideally, the first hourly candle should take care of it. If that happens, strong momentum can follow.

Otherwise, Nifty might just consolidate for a bit.

Intraday levels for tomorrow:

- Support: 25044

- Resistance: 25202

If 25202 breaks, direct upside target is 25350.

Coming to NSE:BANKNIFTY — today’s candle is indecisive.

If strong momentum doesn’t follow soon, it could drop again.

So it’s important for BankNifty to close above 57098 within the first hour tomorrow.

Support zone will be around 56590.

Talking about sector rotation — NSE:CNXMEDIA topped the charts today. So special focus should be there for intraday trades.

That said, short-term leadership is still with IPOs, Pharma, and Realty sectors.

Right now is the best time to identify quality breakout stocks.

But remember, you also need a solid position management strategy.

Most traders make the mistake of exiting too early in bull markets with small profits — that’s greed.

In bull phases, the goal should be to ride the trend. Don’t follow feelings. Follow your setup.

Stocks like NSE:HPL and NSE:DBREALTY are showing great setups.

Study these setups carefully. Learn from them. Never blindly copy others.

That’s all for today.

Take care.

Have a profitable day ahead.

Master Institutional TradingInstitutional trading refers to the buying and selling of financial assets—stocks, bonds, derivatives, commodities, currencies—by organizations that invest large sums of money. These trades are typically large in volume and value and are executed through private negotiations or electronic networks designed for block trading.

Key Characteristics:

High volume orders

Priority on stealth execution

Access to premium data

Quantitative modeling

Advanced algorithms

Banknifty analysis for the upcoming movement in the index.Banknifty has been trading in a range for a long time and is now trading around the support levels of 56600.

The RSI indicator on the daily charts is showing some bearish divergence and today the market has taken a halt after 2 days of fall.

If the market starts travelling on the lower side there are chances of testing the lower support level of 56120.

The market has been trading in a range of 56600 to 57600. And the support is tested many a times.

Bullish trades can be initiated for intraday play only once the market starts sustaining above today's high of 56900.

Moving averages are also forming a resistance gate around the resistance level. Watch for the breakout and enter only on the retest of the levels.

Major support levels :- 56600, 56270, 56120

Resistance levels :- 56900, 57285

Wait for the price action and trade according to the price action.

Option TradingInvesting Approach by Institutions

✅ Investment Philosophy:

Long-term horizon

Focus on fundamentals (P/E, ROE, growth)

Sector rotation and macro trends

✅ Allocation Strategies:

Strategic Asset Allocation (SAA)

Tactical Asset Allocation (TAA)

Smart Beta and Factor Investing

Trading Strategies by Institutions

🔹 High-Frequency Trading (HFT)

Executes thousands of trades in milliseconds

Relies on arbitrage, price inefficiencies

🔹 Statistical Arbitrage

Mean-reversion strategies using historical patterns

🔹 Swing & Trend Trading

Use technical indicators like MACD, Moving Averages, RSI

Advance Option Trading Why Institutions Prefer Options

Leverage – Control large positions with small capital

Risk Management – Protect portfolios

Cash Flow – Earn premium income

Volatility Play – Earn from IV rise/fall

Customization – Tailored exposure using exotic options

Core Strategies Used by Institutions

1. Protective Puts

Buy puts to insure large stock holdings against downside risk.

2. Covered Calls

Earn premium income on long-term stock holdings.

3. Calendar Spreads

Take advantage of time decay and volatility differences.

4. Straddles & Strangles

Bet on volatility movement, not direction.

Tools Used by Institutional Option Traders

Bloomberg Terminal – Real-time data, pricing models

Quantitative Models – Black-Scholes, Binomial Trees

Algo Execution – Smart order routing

Risk Management Software – VaR, Greeks analysis

Option Analytics Platforms – Orats, Trade Alert

Option TradingInstitutional Trading – The Backbone of Markets

✅ Who Are Institutional Traders?

They are big market participants such as:

Pension Funds

Insurance Companies

Hedge Funds

Mutual Funds

Foreign Institutional Investors (FIIs)

✅ Why Are They Important?

Provide liquidity in markets

Trade with large volumes

Influence market trends

Institution Option Trading What Is Trading?

Trading refers to buying and selling financial instruments (stocks, options, futures) in financial markets for profit. It can be:

Retail Trading – Done by individual investors.

Institutional Trading – Conducted by large organizations like banks, mutual funds, hedge funds.

What Is Investing?

Investing involves allocating capital with the expectation of long-term wealth generation. It focuses on:

Value appreciation

Dividends or returns over time

Longer holding periods

BANKNIFTY : Trading levels and Plan for 14-Jul-2025📊 BANK NIFTY INTRADAY PLAN – 14 JULY 2025 (15-Min Chart Analysis)

Educational breakdown for gap-up, flat, and gap-down opening scenarios. Refer to chart zones carefully before executing trades.

📍 Previous Close: 56,712.85

📌 Gap opening threshold: 200+ points

⏱️ Tip: Allow the first 15–30 minutes for price settlement before acting on levels.

📌 KEY LEVELS TO MONITOR

Resistance Zone: 57,164

Last Intraday Resistance: 56,974

Opening Resistance Zone: 56,834

Opening Support/Resistance Zone: 56,688 – 56,640

Buyer's Support Zone: 56,427 – 56,330

Major Support (Breakdown Zone): 56,202

🚀 SCENARIO 1: GAP-UP OPENING (Above 56,834) 📈

Bias: Bullish with caution at upper resistance zones

If Bank Nifty opens above 56,834 , expect a direct test of Last Intraday Resistance: 56,974 .

Sustainable strength above 56,974 can lead towards 57,164 . This is the final resistance zone where booking profits is advisable.

If prices hit 57,164 early in the day, avoid chasing. Wait for a pullback and observe whether 56,974 holds as support.

On strong bullish momentum, avoid deep OTM call buying — stick with ATM/ITM options for safer theta exposure.

📊 SCENARIO 2: FLAT OPENING (Near 56,712 – 56,688) 🔄

Bias: Neutral-to-bearish depending on first hour structure

If opening is near 56,712 – 56,688 , focus on whether 56,688–56,640 (Opening Support/Resistance Zone) holds.

If price breaks and sustains below 56,640, expect a move toward Buyer’s Support Zone: 56,427 – 56,330 .

Best setups would come if price consolidates above or below this opening zone for 30–45 minutes before directional confirmation.

Wait for breakdown candle confirmation before taking PE trades. Avoid random entries in choppy structure.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,502) ⚠️

Bias: Bearish with buy-on-dip potential at key support

If opening is below 56,502 , Bank Nifty may directly drift towards Buyer’s Support Zone: 56,427 – 56,330 .

Expect sharp reaction candles from this zone. This is where aggressive intraday buyers may step in.

If even 56,330 breaks, a further slide towards 56,202 becomes likely — avoid catching falling knives below this level unless there’s a clear structure forming.

For conservative traders, avoid counter-trading until price reclaims 56,688 after breakdown.

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

Use ATM or ITM options in fast-moving markets; avoid deep OTM trades as theta eats premium quickly.

If VIX is high, apply hedging strategies like vertical spreads to manage risk.

Avoid initiating trades based on the first 5-minute candle alone; confirmation is key.

Never risk more than 1–2% of total capital on any single trade.

Watch Bank Nifty along with Nifty and broader sector indices like PSU Banks for confirmation.

Avoid re-entry into the same trade direction after 2:45 PM to reduce event risk.

📌 SUMMARY & CONCLUSION

Bullish Trigger: Above 56,834 → Target 57,164

Neutral Zone: 56,712 – 56,688 → Wait for structure clarity

Bearish Trigger: Below 56,640 → Watch 56,427 – 56,330 for bounce

Trade with discipline, respect levels, and follow confirmation logic before acting.

Options buyers must avoid holding positions post 3 PM if trades are not in favor.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please do your own research or consult your financial advisor before trading.

Nifty ready to Bounce As mentioned in Friday’s commentary — a gap-down was expected in NSE:NIFTY , and that’s exactly what we saw.

I highlighted that the gap-down could happen below 25285 — and the market opened at 25255.

A bounce was expected near 25333 — and the bounce actually came, up to 25322.

It was clearly stated that selling should be done on bounce — and from there, the market dropped nearly 180 points from the high.

In short — the analysis played out exactly as planned.

Now, since everything is moving as per plan, it would be incorrect to assume that the market has turned bearish.

The Nifty chart is simply indicating that due to the earnings season, institutional money is rotating from one set of stocks to another.

So, this is not a downtrend or a selloff — it’s just a basic quarterly rotation which mutual funds are required to do every quarter as part of their rule-book.

Funds are being booked from run-up or overbought stocks, and re-invested into undervalued stocks — stocks that are now setting up for a fresh move and belong to stronger indices or sectors.

✅Your focus should be on spotting such stocks and sectors early.

Now, coming to Friday’s Nifty candle — it’s showing a bullish hidden divergence.

Which means — there’s a high probability of a strong bounce.

However, there’s a caution: the first one hour of the market might remain sideways or slightly bearish.

So avoid early entries — wait for a clear bounce signal.

Let’s talk about the key technical levels:

Resistance: 25225 — once crossed, the next resistance is at 25350.

Support: 25125 — if this breaks, index may fall to 25071, and further to 24955 if pressure continues

The time-wise correction seems almost complete — and next week looks promising for a solid move.

Sector-wise, IPOs, Healthcare, FMCG, and Pharma are currently showing the most strength.

Speaking of NSE:BANKNIFTY — it has already shown the first sign of bounce by holding support at 56600. Immediate resistance is at 56900.

From today, you can start scanning for strong breakout stocks — like NSE:HPL

That’s all for today’s commentary.

Take care. Have a profitable tomorrow.

Sensex Dives Below ₹82,600 — IT Stocks Drag Index DownFrom a technical standpoint, Sensex breaking below ₹82,600 is important. This was seen as a short-term support level. Now that it's broken, ₹82,280 and ₹82,060 are the next zones to watch for.

Moving Averages:

Sensex has slipped below its 20-day moving average, which is often used as a trend indicator.

This shows short-term weakness and signals caution for traders.

RSI (Relative Strength Index):

RSI is heading lower but not yet in oversold territory.

This means there could be more downside before a potential bounce.

MACD:

The MACD indicator is also showing bearish crossover – another sign that the market could stay weak in the near term.

What Should Traders & Investors Do Now?

For Traders:

This is a time to stay cautious.

Avoid taking aggressive long positions unless Sensex reclaims ₹83,000+ with strong volume.

Focus on stock-specific opportunities in sectors like FMCG, pharma, or even PSU banks.

For Long-Term Investors:

Don’t panic. Corrections like these are common.

Instead of trying to time the market, look for quality stocks at attractive valuations.

IT stocks are fundamentally strong, so long-term investors can accumulate slowly on dips, especially if they fall further.

Global Factors at Play

What happens in the global economy directly affects Indian markets. Here are some international cues that are influencing Sensex:

US Interest Rates:

The US Federal Reserve may raise interest rates again to fight inflation.

Higher rates make borrowing expensive, slow down spending, and can trigger a global slowdown.

China's Economic Data:

Slower growth in China has worried global investors.

A slowdown in Asia’s biggest economy has ripple effects on global demand.

Geopolitical Tensions:

Trade issues, especially between the US and China, are creating uncertainties.

Wars or unrest in regions like Ukraine or the Middle East also cause global instability.

What to Watch in Coming Days

Key Events:

More Q1 results from major companies

Global inflation data releases

FII (Foreign Institutional Investors) activity – whether they continue selling or start buying

Crude oil price movement – as it affects inflation and currency

RBI commentary on interest rates

📢 Final Thoughts

The fall in Sensex below ₹82,600 is a signal for caution, not panic. The IT sector’s weakness has triggered the fall, but the overall market is still stable when compared to global peers.

For serious investors, this is a good time to review portfolios, build a watchlist, and focus on quality stocks and sectors that show relative strength. Defensive sectors like FMCG and pharma are showing signs of leadership.

Market cycles are natural – after every fall, there's a recovery. The key is to stay updated, stay disciplined, and not let emotions drive your decisions.

Banknifty 1day time frame📊 Current Status (as of today)

Bank Nifty is trading around: ₹56,750 – ₹56,800

It's just below its all-time high, which is around ₹57,628.

The trend is still positive (bullish), but it’s taking a breather after a big rally.

🛡️ Strong Support Zones (Buy on Dip Areas)

These are the price areas where Bank Nifty may bounce back if it falls:

₹55,500 – ₹55,700 → Minor support

₹54,300 – ₹54,500 → Stronger support zone (good for long-term entry)

₹52,500 – ₹53,000 → Very strong base; ideal for adding long-term positions if market corrects

🚀 Resistance Levels (Where Price Might Struggle)

These are areas where it might face selling pressure:

₹57,000 – ₹57,200 → Near-term resistance

₹57,600 – ₹57,800 → All-time high zone

Above ₹58,000 → Fresh breakout, could fly to new levels if crossed with volume

✅ What You Can Do (If You’re a Long-Term Investor)

If you already hold: Stay invested. Trend is still up.

If you want to buy:

Wait for a dip to around ₹54,300–₹55,000 for a safer long-term entry.

Or, buy small now and add more on dips.

Breakout Strategy: If Bank Nifty closes above ₹57,800, it may start a new rally.

📌 Summary in One Line:

“Bank Nifty is near its highs — still bullish, but don’t chase. Buy dips around ₹54,500 or add more only if it breaks above ₹57,800.”

We Might See 25000 Level Testing in Nifty Today's price action in NSE:NIFTY formed a classic Supply Candle—indicating strong seller dominance with hardly any buying interest throughout the session.

Heading into tomorrow, we are likely to witness one of two potential scenarios:

Scenario 1:

We may open with a gap-down, driven by the pressure of today’s supply. If that happens, expect the opening to be below 25285.

In this case, avoid buying the dip. Instead, look to sell on any intraday bounce near 25333.

Scenario 2:

Alternatively, we could see a mild gap-up due to call unwinding, triggered by the emergence of a new resistance zone.

If the index approaches 25400, that will be a strong supply area. In such a scenario, look to initiate short positions near 25400 with a stop-loss around 25433 (on hourly closing basis).

Also, keep an eye on 25222. If we bounce from this level in the second half, it would suggest strength returning for the coming week.

However, a failure to hold this support and a close below it could push us towards the 25000 mark.

NSE:BANKNIFTY also continues to show weakness. Immediate support is around 56700, while resistance stands at 57100.

With earnings season underway, this is a crucial time to focus on the Earning Pivot strategy.

Stay selective—only trade setups with strong earnings-backed pivots.

On the sectoral front, Power continues to lead. I traded NSE:HPL today which still looks good.

Next in line are NSE:CNXFMCG and #SUGAR—both sectors showing early signs of strength.

Let me remind you—chaos often breeds the best opportunities. Use this phase to curate your watchlist for the next leg of the rally.

That will be all for today. Trade smart and have a profitable tomorrow.

BANKNIFTY : Trading levels and Plan for 11-Jul-2025📊 BANK NIFTY INTRADAY PLAN – 11 JULY 2025 (15min TF)

An educational and actionable trading strategy based on technical zones and opening behavior.

📍 Reference Close: 56,956.95

📈 Gap Opening Threshold: 200+ points

⏱️ Pro Tip: Let the market stabilize in the first 15–30 mins before entering trades for better confirmation.

📌 KEY LEVELS TO WATCH

Opening Resistance: 57,123

Last Intraday Resistance: 57,223

Profit Booking Zone: 57,609 – 57,678

NO TRADE ZONE: 57,020 – 56,910

Last Intraday Support: 56,768

Support for Consolidation: 56,436 – 56,518

Buyer's Support (Must Try Zone): 56,202 – 56,304

📈 SCENARIO 1: GAP-UP OPENING (Above 57,123)

Bias: Bullish, but caution at higher resistances

If Bank Nifty opens above 57,123 , momentum can build toward 57,223 , the last intraday resistance.

A breakout and sustained close above 57,223 opens the door for a move toward the Profit Booking Zone: 57,609–57,678 .

Watch for exhaustion signs like long upper wicks or volume drop at those higher zones to secure profits.

Avoid chasing CE options if IV is high post-gap-up; wait for consolidation or retracement.

📊 SCENARIO 2: FLAT OPENING (Between 57,020 – 56,910) – NO TRADE ZONE 🟧

Bias: Indecisive — Let market choose direction first

A flat open inside the No Trade Zone suggests potential chop and fakeouts.

Avoid fresh positions in this zone unless you get a decisive breakout above 57,123 or breakdown below 56,910 .

Use this time to observe option premium behavior and build directional bias based on price/volume cues.

Patience will be more profitable than premature trades here.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,768)

Bias: Bearish to potential bounce plays

A gap-down below 56,768 puts bears in control, with support at 56,436–56,518 .

If prices break below that consolidation zone, expect a move towards Buyer’s Support Zone: 56,202 – 56,304 , where reversal is possible.

Look for bullish reversal candles at the lower zone for call buying or intraday pullback trade.

If breakdown continues below 56,200, avoid bottom fishing – stick with the trend.

💡 OPTIONS TRADING RISK MANAGEMENT TIPS

Avoid buying OTM options blindly on a gap-up or gap-down – IV crush is real!

Wait for a candle confirmation before jumping into a trade.

Use 15-minute candle close-based SL to prevent getting whipsawed.

Avoid trading in No Trade Zone unless a clear direction is established.

Use vertical spreads to limit risk and hedge positions.

Protect profits after 2 PM – avoid entering new trades in the last hour unless very high conviction.

📌 SUMMARY & CONCLUSION

Bullish Momentum: Above 57,123, target 57,609–57,678

Neutral/Choppy Zone: 57,020 – 56,910 – avoid taking trades here

Bearish Zone: Below 56,768, with bounce watch at 56,202–56,304

Let price action confirm your bias before committing capital

Control risk with predefined SL and avoid emotional trading

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. The above analysis is for educational purposes only. Please consult a certified financial advisor before making trading decisions.