PNC Infra- Inverted Head and Shoulder Pattern1⃣ Pattern Structure & Breakout Development 📈

📐 Pattern Identification : Inverted Head and Shoulder Pattern – a powerful bottom reversal pattern, signaling the end of a prolonged downtrend and readiness for upside expansion.

⏳ Time Taken in Formation : The pattern matured over 7 months (from Dece

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

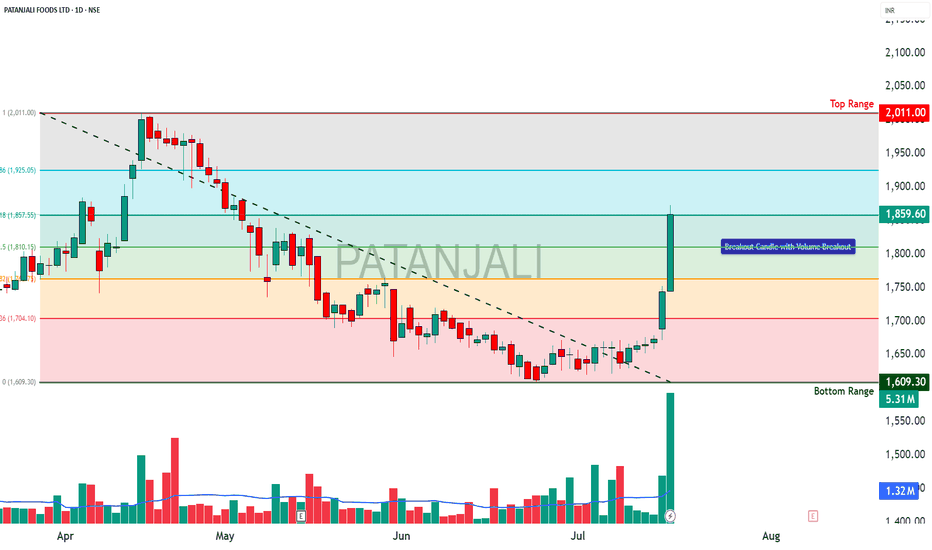

PATANJALI - OPTIONS TRADE SETUPPATANJALI OPTIONS TRADE SETUP – 17 JULY

Spot: ₹1859.6

Trend: Bullish

Volatility: Moderate IV rise (38–41%)

Lot Size: 300

________________________________________

1. Bullish Trade (Naked options as per trend)

Best CE: Buy 1860 CE @ ₹59.45

Why: Strong continuation signal with rising OI and price, heav

#Advait | Parabolic Setup Reloaded? Retesting All-Time Highs🔍 #OnRadar

#Advait (Advait Energy Transitions Ltd.)

CMP: 2,087

Technical View (Educational Purpose Only):

Stock is once again showing signs of a #ParabolicMove in progress. Earlier, it broke out from #Base1 at 431.80 and rallied to 2,260 — a remarkable ~400% move in just 8 months .

ANANTRAJ Price Action

## Current Price & Performance

- Last close was ₹607.20.

- Over the past week, the stock is up more than 10%, showing strong short-term momentum.

- Over the past year, it has gained nearly 25%, but suffered a sharp 32% drawdown over six months.

- The 52-week price ranged from ₹376.15 to ₹947.90, r

CYIENT- Flag SetupWe all know that price generally moves in two phases- Contraction and Expansion. Setups like rectangle, Flag or Triangles generally represent contraction. The stock squeezes in these narrow setups and then jumps on to the next phase that is Expansion. Expansions are generally strong impulsive moves

Nifty July Iron Condor Strategy – Premiums are Still Attractive!Hello Traders!

After a strong April, May and June where all three our option writing strategies gave full profits, we are back again with the July edition. Market is respecting the range beautifully, and we are again going with a non-directional Iron Condor setup.

Let’s walk through the logic and

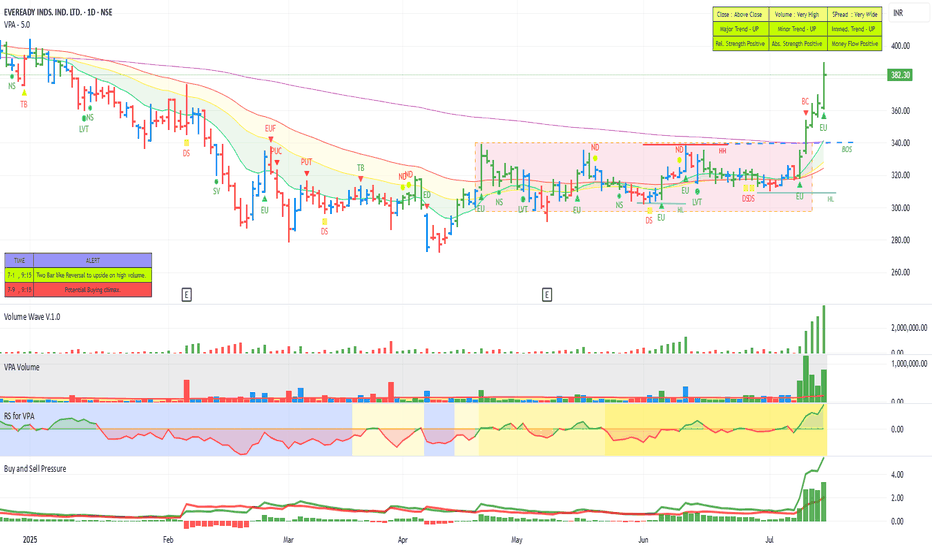

EVEREADY - POISED FOR A UPMOVEThe stock fell about 45% form it's last Peak. Then an attempt to move up and more than two months of consolidation . Now making Higher Highs and Higher lows and moving past the short term moving averages and the 200 DMA. We can see strong momentum and bullish volume and increasing Relative streng

Market Analysis and Nifty AnalysisIn this video, I have provided an overall market analysis. :

Although the market is green today, it's important to stay cautious.

Small caps are forming range-bound bullish engulfing candles, but we need to wait for the closing.

Nifty continues to form lower lows on the lower time frame. A

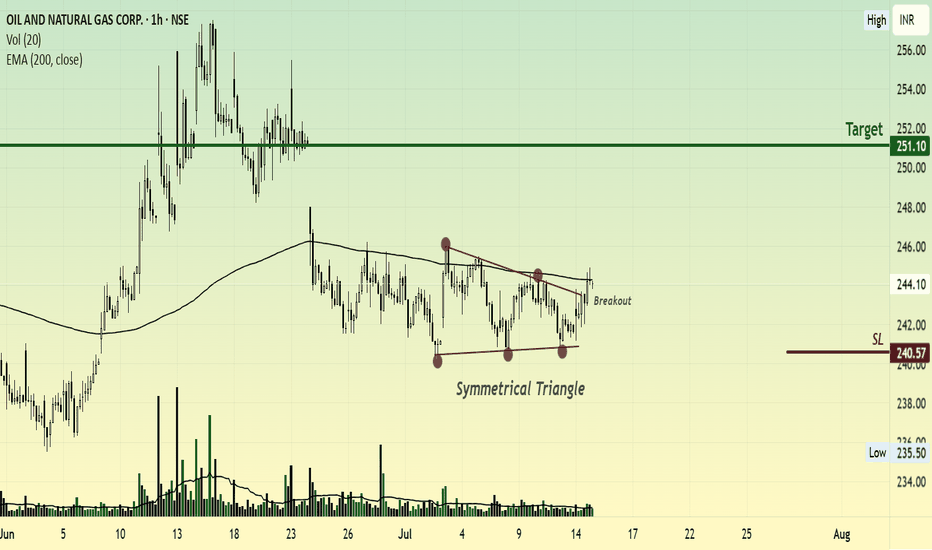

ONGC might fill the Gap!Points to consider:

----------------------

1. A symmetrical triangle consolidation breakout

2. Stock testing 200ema repeatedly

3. A gap filling trade is possible, with a strong triangle base.

DISCALIMER : This is NOT a trade recommendation but only my observation. Please tale trades based on yo

See all editors' picks ideas

Crowding model ║ BullVision🔬 Overview

The Crypto Crowding Model Pro is a sophisticated analytical tool designed to visualize and quantify market conditions across multiple cryptocurrencies. By leveraging Relative Strength Index (RSI) and Z-score calculations, this indicator provides traders with an intuitive and detailed sn

Dynamic Gap Probability ToolDynamic Gap Probability Tool measures the percentage gap between price and a chosen moving average, then analyzes your chart history to estimate the likelihood of the next candle moving up or down. It dynamically adjusts its sample size to ensure statistical robustness while focusing on the exact de

EVaR Indicator and Position SizingThe Problem:

Financial markets consistently show "fat-tailed" distributions where extreme events occur with higher frequency than predicted by normal distributions (Gaussian or even log-normal). These fat tails manifest in sudden price crashes, volatility spikes, and black swan events that traditi

Divergence Screener [Trendoscope®]🎲Overview

The Divergence Screener is a powerful TradingView indicator designed to detect and visualize bullish and bearish divergences, including hidden divergences, between price action and a user-selected oscillator. Built with flexibility in mind, it allows traders to customize the oscillator

Logarithmic Moving Average (LMA) [QuantAlgo]🟢 Overview

The Logarithmic Moving Average (LMA) uses advanced logarithmic weighting to create a dynamic trend-following indicator that prioritizes recent price action while maintaining statistical significance. Unlike traditional moving averages that use linear or exponential weights, this indic

Volumatic Support/Resistance Levels [BigBeluga]🔵 OVERVIEW

A smart volume-powered tool for identifying key support and resistance zones—enhanced with real-time volume histogram fills and high-volume markers.

Volumatic Support/Resistance Levels detects structural levels from swing highs and lows, and wraps them in dynamic histograms that re

True Close – Institutional Trading Sessions (Zeiierman)█ Overview

True Close – Institutional Trading Sessions (Zeiierman) is a professional-grade session mapping tool designed to help traders align with how institutions perceive the market’s true close. Unlike the textbook “daily close” used by retail traders, institutional desks often anchor their

Open Interest Footprint IQ [TradingIQ]Hello Traders!

Th e Open Interest Footprint IQ indicator is an advanced visualization tool designed for cryptocurrency markets. It provides a granular, real-time breakdown of open interest changes across different price levels, allowing traders to see how aggressive market participation is distribu

Zigzag CandlesCan't deny that I am obsessed with zigzags. Been doing some crazy experiments with it and have many more in pipeline. I believe zigzag can be used to derive better trend following methods. Here is an attempt to visualize zigzag as candlesticks. Next steps probably to derive moving average, atr (alth

MathStatisticsKernelFunctionsLibrary "MathStatisticsKernelFunctions"

TODO: add library description here

uniform(distance, bandwidth) Uniform kernel.

Parameters:

distance : float, distance to kernel origin.

bandwidth : float, default=1.0, bandwidth limiter to weight the kernel.

Returns: float.

triangular(distance

See all indicators and strategies

Community trends

PNC Infra- Inverted Head and Shoulder Pattern1⃣ Pattern Structure & Breakout Development 📈

📐 Pattern Identification : Inverted Head and Shoulder Pattern – a powerful bottom reversal pattern, signaling the end of a prolonged downtrend and readiness for upside expansion.

⏳ Time Taken in Formation : The pattern matured over 7 months (from Dece

RRKABEL: Cup & Handle Pattern Could Trigger 30% Upside RallyNSE:RRKABEL Perfect Storm: How Cup & Handle Pattern Could Trigger 30% Upside Rally

Price Action Analysis:

Candlestick Patterns:

- Doji Formation: Multiple doji candles during handle formation indicate indecision and potential reversal

- Bullish Engulfing: Strong bullish engulfing pattern on b

PATANJALI - OPTIONS TRADE SETUPPATANJALI OPTIONS TRADE SETUP – 17 JULY

Spot: ₹1859.6

Trend: Bullish

Volatility: Moderate IV rise (38–41%)

Lot Size: 300

________________________________________

1. Bullish Trade (Naked options as per trend)

Best CE: Buy 1860 CE @ ₹59.45

Why: Strong continuation signal with rising OI and price, heav

Swan Energy Breaks Out After 5-Month Consolidation | Bullish MomSwan Energy has broken out of a long 5-month consolidation range between ₹390 and ₹480 with a strong volume spike, signaling a potential trend reversal and bullish continuation.

Key Technicals :

Breakout Level: ₹480

Current Price: ₹521.95

Volume: Significantly higher than average → Indicates str

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

#Advait | Parabolic Setup Reloaded? Retesting All-Time Highs🔍 #OnRadar

#Advait (Advait Energy Transitions Ltd.)

CMP: 2,087

Technical View (Educational Purpose Only):

Stock is once again showing signs of a #ParabolicMove in progress. Earlier, it broke out from #Base1 at 431.80 and rallied to 2,260 — a remarkable ~400% move in just 8 months .

IOC - Breakout Candidate? Jump now or wait it out?

Levels are marked for easy/better understanding.

The chart looks like a clean breakout

But the following aspects makes me feel that it could give one DIP before resuming higher.

RSI looks stretched and trading in overbought territory on hourly and 4 hour TF

Weekly SuperTrend is at 152 levels

Mastering Multi Time Frame Analysis | Swing and Intraday TradingWhether you're a price action trader or rely on indicators, mastering Multi Time Frame (MTF) Analysis can transform your swing and intraday trading decisions. In this video, I break down how to use MTF effectively to align your entries, spot fakeouts, and trade with higher conviction.

See all stocks ideas

Today

AURUMAURUM PROPTECH LTD

Actual

—

Estimate

−1.40

INR

Today

INDIAMARTINDIAMART INTERMESH LTD

Actual

—

Estimate

20.14

INR

Today

MRPLMRPL

Actual

—

Estimate

1.90

INR

Today

AVANTELAVANTEL LTD

Actual

—

Estimate

—

Today

KTKBANKKARNATAKA BANK LTD

Actual

—

Estimate

6.80

INR

Today

MASTEKMASTEK LTD

Actual

—

Estimate

28.87

INR

Today

HINDZINCHINDUSTAN ZINC LTD

Actual

—

Estimate

5.00

INR

Today

HATSUNHATSUN AGRO PRODUCT LTD.

Actual

—

Estimate

—

See more events

Community trends

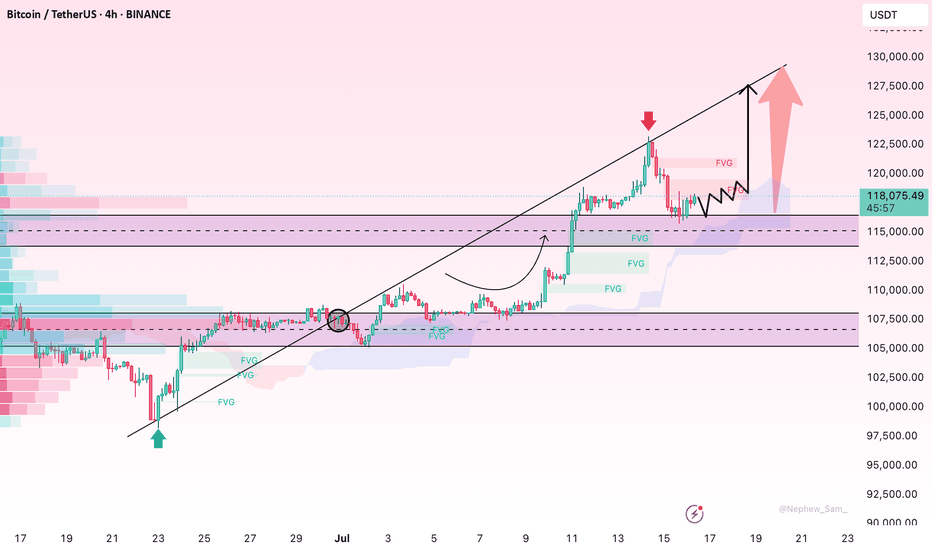

BTCUSDT – Breakout confirmed, bullish momentum continuesBTCUSDT has officially broken above a long-standing resistance channel, confirming a breakout and establishing a base around the nearest Fair Value Gap. The price action maintains a clear uptrend structure with consecutive higher lows and higher highs, supported by consistent buying pressure after m

Bitcoin’s Pullback: A Strategic Pause Before the Next Surge?After a sharp rally past the $122,000 mark, Bitcoin is now undergoing what appears to be a textbook pullback — not a sign of weakness, but a calculated pause. On the H4 chart, BTC has retraced into the $115,000–$117,000 zone, aligning perfectly with a key Fair Value Gap (FVG) left unfilled during th

BTC/USD Pullback: What’s Next for Bitcoin?Hello, passionate and wealthy traders! What are your thoughts on BTC/USD?

After a strong surge above the 122,500 USD zone, BTC/USD has started to experience a slight pullback. This is completely normal and necessary for Bitcoin to gain new momentum.

In my personal view, the recent peak of BTC/USD

BTCUSD Technical Analysis – Break of Structure + SupportBTCUSD Technical Analysis – Break of Structure + Support/Resistance Strategy

🔍 Market Structure Insight

The chart clearly shows multiple Breaks of Structure (BOS) throughout the uptrend, indicating strong bullish momentum. Each BOS confirms a higher high formation and continued market strength.

📌

PENGUUSDC - Breakout SetupCOINBASE:PENGUUSDC

Charts are self-explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selli

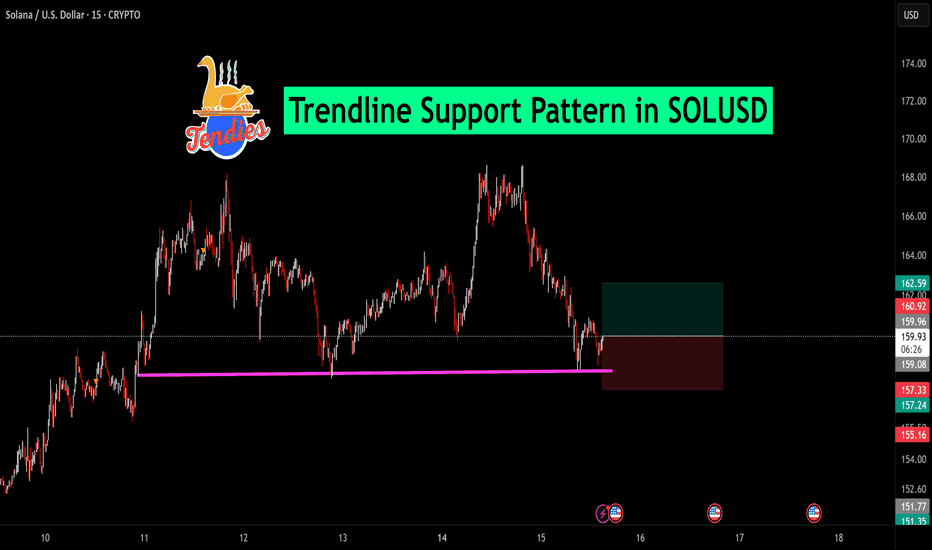

Trendline Support Pattern in SOLUSDSolana (SOLUSD) is currently holding a critical horizontal trendline support near the $157.20–$157.30 zone. Price has tested this level multiple times, confirming strong buyer interest around this area.

📈 Long Trade Setup:

Entry: Around $159.88

Stop Loss: Below $157.24

Target Zone: $162.59 and a

Solana Long-Term Cup & Handle | +300% Potential🔍 #OnRadar | #Crypto

#SOLUSD (#Solana)

Solana Long-Term Cup & Handle | +300% Potential

CMP: $174

Support Zone: $123.00 – $100.00

Pattern Invalidation Level: $95 (MCB - Monthly Closing Basis)

📊 Technical Overview:

Solana (SOLUSD) is showing signs of a long-term Cup & Handle pat

See all crypto ideas

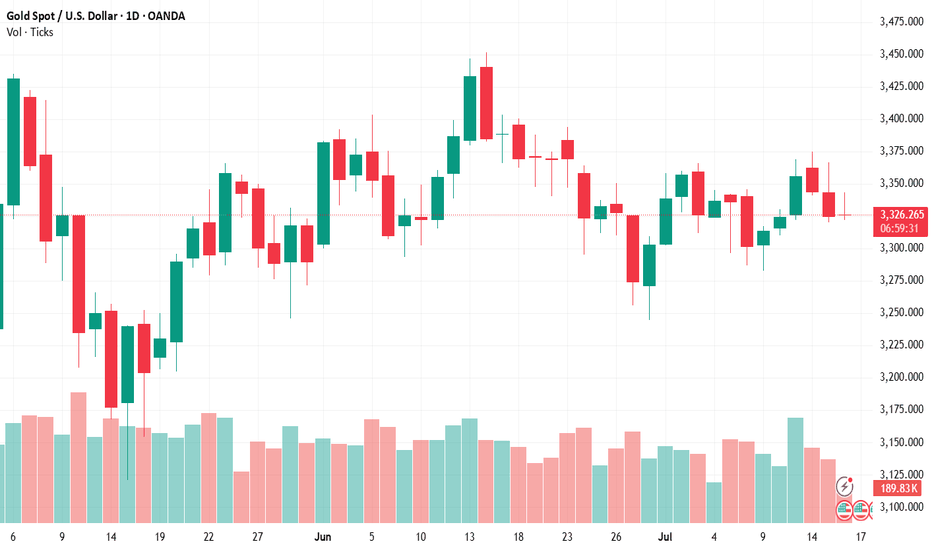

Gold XAUUSD Trading Strategy on July 16, 2025Gold XAUUSD Trading Strategy on July 16, 2025:

Yesterday's trading session was in line with our prediction, the gold price corrected strongly after meeting the resistance zone of 336x. However, the support zone of 333x did not help the gold price continue to maintain the sideway range.

Basic news:

Gold Prices Volatile Amid Economic Data and Trade TensionsGold prices saw strong fluctuations yesterday, dropping near 3,320 USD/ounce before quickly recovering and rising to 3,370 USD/ounce, a difference of about 50 USD, fueled by U.S. PPI data. However, by the end of the session, the price dropped back and is now trading around 3,340 USD/ounce, with litt

Gold Trading Strategy for 17th July 2025📈 GOLD ($) INTRADAY STRATEGY ALERT 📉

(1-Hour Candle Confirmation Based Entry)

🔹 BUY Setup – Long Trade

📌 Entry Condition:

👉 Buy above the high of the 1-hour candle that closes above $3364

🎯 Targets:

🎯 Target 1: $3375

🎯 Target 2: $3386

🎯 Target 3: $3397

🛡️ Stop Loss: Just below the low of the brea

Gold Surges After Softer PPI – Is a New Rally in the Making?Gold spiked sharply following a cooler-than-expected U.S. PPI for June, signaling easing inflationary pressures at the producer level. This immediately triggered a pullback in the dollar and yields, reigniting flows into precious metals.

On the H2 chart, gold rebounded strongly from the $3,325 supp

XAU/USD Ascending Triangle Breakout Setup Pattern: Ascending Triangle

Bias: Bullish (Breakout Imminent)

Entry Zone: Around 3338 (Current Market Price)

Target Zone: 3401 and beyond

Invalidation: Below 3322

📌 Technical Breakdown:

Higher Lows building momentum from April till July ✅

Flat Resistance Zone around 3400 acting as a ceiling ⛔

Vo

Gold’s Next Move After False Headlines & Liquidity sweepXAUUSD 17/07 – MMF Insights: Gold’s Next Move After False Headlines & Liquidity Sweep

🧭 Market Sentiment: Macro Distractions Fuel Uncertainty

The gold market remains under pressure as conflicting geopolitical news and central bank rumors stir volatility. The week opened with rumors that Donald Trump

Gold wavers under pressure from strong U.S. retail dataXAUUSD is currently fluctuating within a price box, showing weaker bullish attempts and failing to break above the nearest resistance zone. Selling pressure is mounting as price continues to be rejected at the top and is approaching the medium-term ascending trendline — a key support level.

On the

XAUUSD Structure Analysis | Smart Money ConceptsXAUUSD Structure Analysis | Smart Money Concepts | July 17, 2025

Market Overview:

Gold (XAUUSD) is currently trading around the $3,328 level, showing clear Smart Money behavior with multiple Breaks of Structure (BOS), liquidity grabs, and reactions from key zones. The chart outlines a well-respected

Gold sold at 3355 today booked at 3311 tomorrow again sell riseHow My Harmonic pattern projection Indicator work is explained below :

Recent High or Low :

D-0% is our recent low or high

Profit booking zone: D13% -D15% is

range if break them profit booking start on uptrend or downtrend but only profit booking, trend not changed

SL reversal zone : SL 2

OH Silver Chart Indicate some bearish tone...Key Points:

Trend:

The price is below the Ichimoku cloud → showing a bearish trend.

The blue and red lines (Tenkan & Kijun) are also in a bearish position.

The price is near the 0.236 Fibonacci level (around $37.78) – acting as a weak support.

Resistance Zone:

Around $38.10 – $38.20

Suppor

See all futures ideas

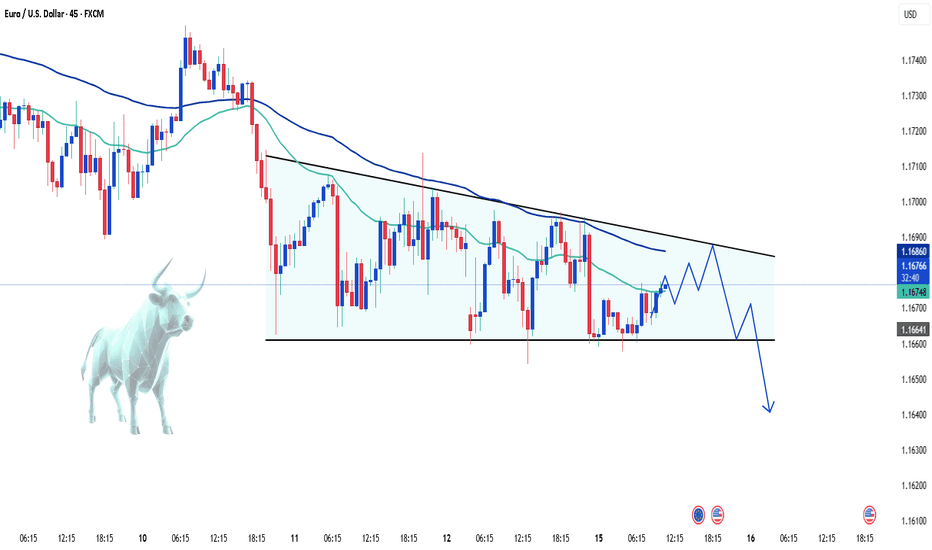

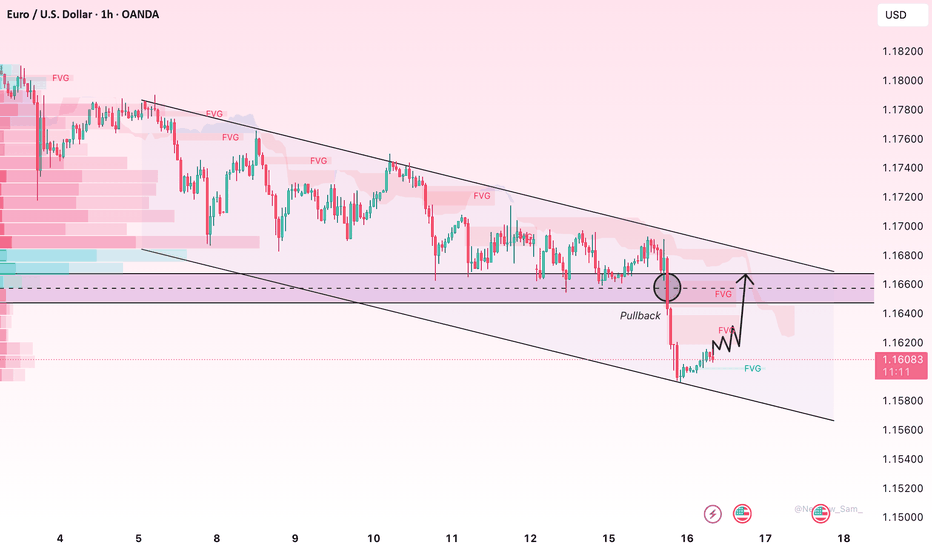

EUR/USD Under Pressure: Will the Downtrend Continue?The EUR/USD exchange rate remains under pressure today, fluctuating below the 1.1700 level as the U.S. dollar gains strength following President Trump's announcement of new tariff letters directed at his two largest trade partners, boosting demand for safe-haven assets.

The downtrend may be further

EURUSD under pressureEURUSD is moving within a well-defined descending channel, forming consistent lower highs and lower lows. The price has recently rejected the resistance zone near 1.16100, showing signs of continued bearish momentum.

On the fundamental side, stronger-than-expected U.S. retail sales—especially in th

EUR/USD Slumps – Shakeout or New Sell-Off?The euro took a sharp nosedive, falling from 1.168 to nearly 1.160 in its steepest drop of the week, after hotter-than-expected U.S. CPI data shocked the market. This move reflects a classic repricing of rate expectations, as traders quickly rotated back into the dollar – the “sleeping giant” now se

"Big Move Loading on EUR/USD! 🔥 "Big Move Loading on EUR/USD! 🚨"perfect Elliott Wave trap is forming – will you catch the fall or get caught at the top? 📉📈

Future Projection (Right Side Drawing)

You have projected a Bearish 5-Wave Impulse (Elliott Wave):

1. The market is expected to reverse from the C wave top (around 1.16023

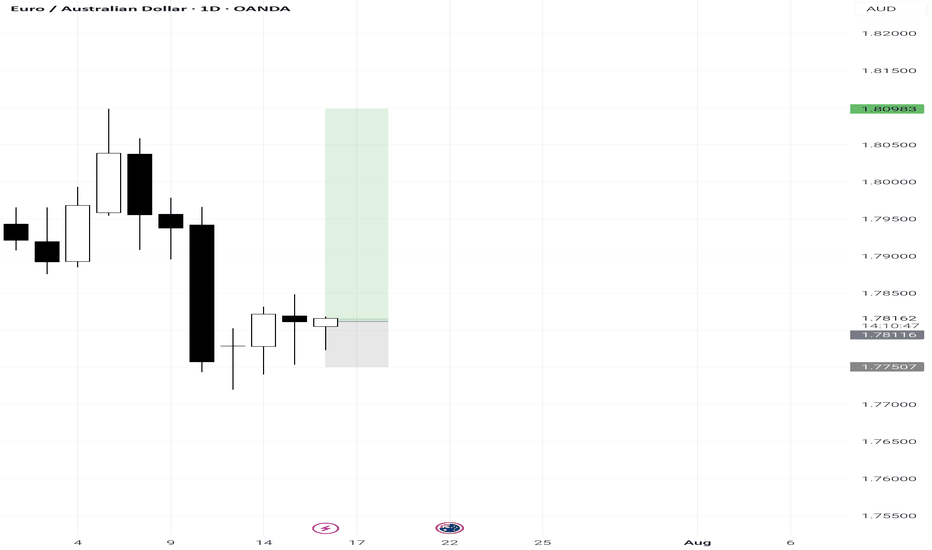

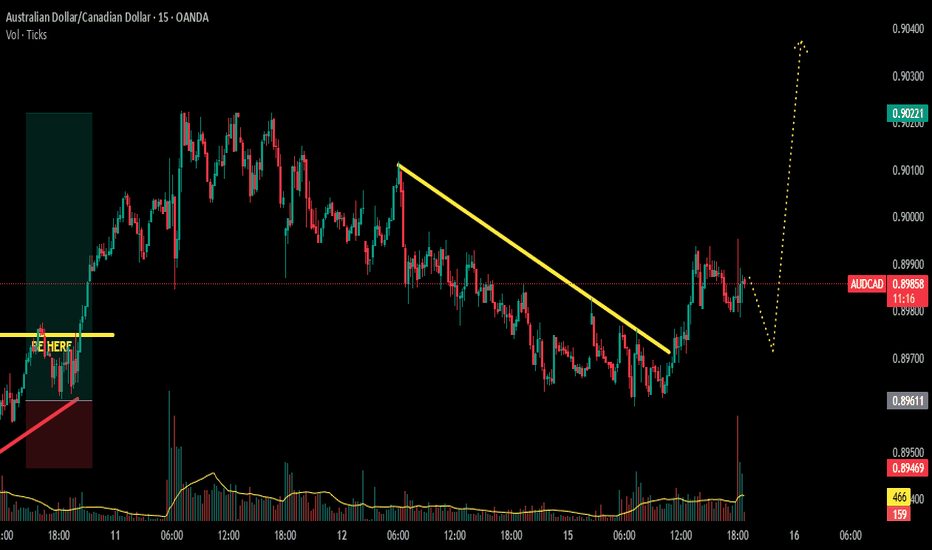

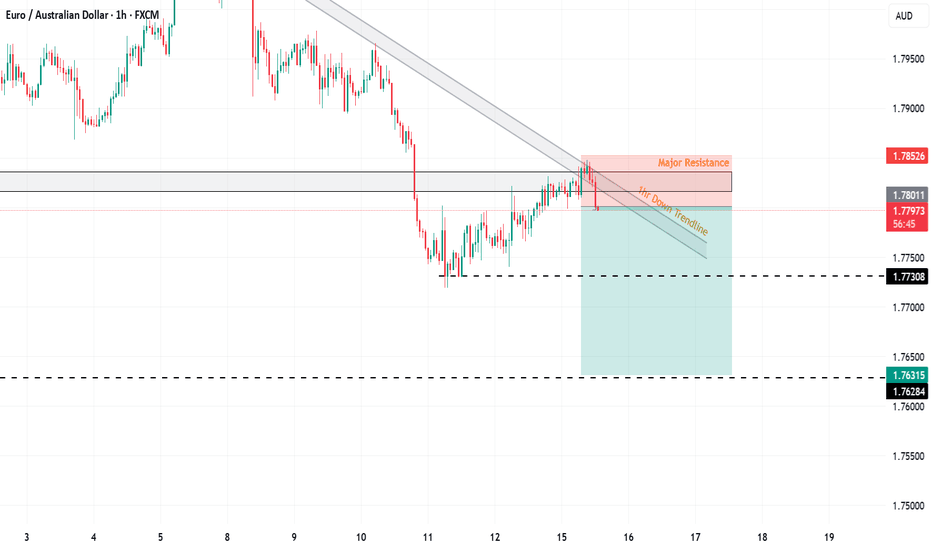

EUR/AUD | 15Min BTST Idea – 15 July 2025📌 EUR/AUD | 1H Idea – 15 July 2025

Bias: Bearish (Rejecting trendline & resistance)

CMP: 1.78002

Market Structure

• Price in consistent lower highs and lower lows under 1H downtrend line.

• Rejected major resistance zone near 1.7850 after retest.

Levels

│ R1 1.78526 │ R2 1.79000

│ S1 1.77308 │ S2

See all forex ideas

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.