iampatilkishor

Premium📌 INDUS TOWERS LTD – Daily Chart Setup 🔹 *Tight Base After Breakdown – Bounce or Breakdown?* 📅 Daily Chart Highlights: • CMP: ₹407.50 • Price stabilizing after sharp fall from ₹426+ • Currently stuck between ₹400 (support zone) and ₹408.50–410 (resistance) • Volume tapering off — indicating a possible squeeze before a move • Price trying to form higher...

📌 YES BANK – Short-Term Setup Near Crucial Pivot 🔹 *YES BANK: Testing Patience or Building Strength?* 📅 Daily Chart Outlook: • CMP: ₹20.29 • Price forming higher lows from ₹17.80 zone — hinting at accumulation • Attempting breakout from ₹20.50–₹20.70 resistance band • EMA cluster near ₹20.10–₹20.30 creating a squeeze zone 🎯 Action Plan: • Entry above...

📌 EQUITY PICK: Kirloskar Brothers Ltd. (KBL) — Fresh Momentum, Fresh Opportunity 🚀 Breakout Pullback Complete? KBL Ready for Next Leg? 📈 Technical Snapshot: Monthly Chart: Strong long-term bullish trend intact. Price retraced and found support at the 20 EMA zone. Fresh bullish candle emerging this month. Daily Chart: Pullback completed near short-term EMAs...

🟢 AEROFLEX INDUSTRIES LTD – Short-Term Swing Setup 📊 Chart: Daily (1D) 📍 CMP: ₹198.33 📅 Date: July 14, 2025 --- 🔍 Technical View: Price bounced after short correction, holding above 20 EMA. Volume spike on prior breakout shows buyer interest. UP signal printed again — showing short-term strength. --- 🎯 Trade Plan: Entry Zone: ₹195–198 Target 1:...

🧿 Stock: Hindustan Foods Ltd 💸 CMP: ₹564.10 📆 Timeframe: Weekly + Daily Confluence 📍 Key Levels • ⚡ Breakout Trigger: ₹567–570 (needs solid close above this) • 🛡️ Immediate Support: ₹544–547 zone (daily 200 EMA cluster) • 🧱 Strong Base: ₹526 📈 Chart Mood • Trend: Sideways turning bullish • Structure: Broke out after long consolidation • Volume: Highest weekly...

💸 CMP: ₹66.29 📍 Key Zones • ⚡ Breakout Trigger: ₹68.20 • 🛡️ Support Floor: ₹63.90 • 🎯 Targets: ₹72 / ₹78 📈 Chart Mood • Trend: Uptrend continuation • Structure: Tight range above 20 & 50 EMA • Volume: Steady → signs of re-accumulation 🧠 Trade Bias • Bias: Bullish above ₹68.2 • Plan: Entry on breakout, SL ₹63.9, trail once ₹72 hits 🎤 Mindset Cue: “Let price...

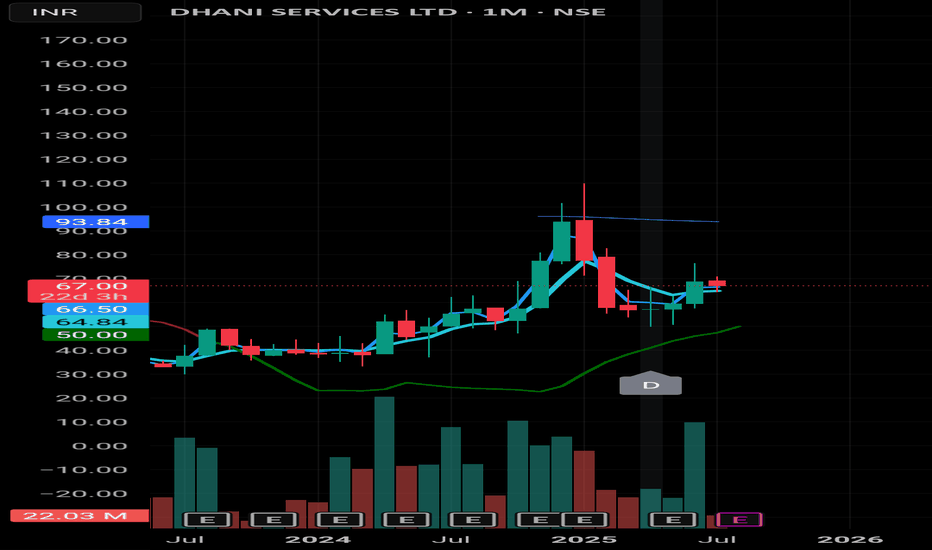

📉 Dhani Services Ltd – Monthly Chart Analysis • Price: ₹67.17 • Setup: Attempting recovery after sharp fall from ₹100+ zone • Facing resistance around 66.50–67.50 (20 EMA & previous support turned resistance) • 93.84 – Long-term resistance (possibly 200 EMA) • Support levels: – ₹64.86 (short-term) – ₹50.02 (major swing base & green trend line zone) 📊 Volume:...

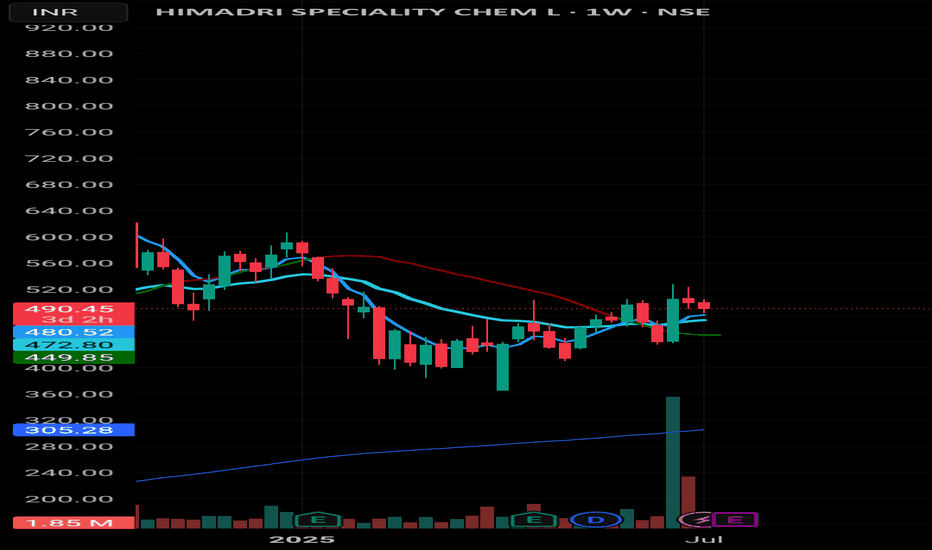

📊 Himadri Speciality Chem – Weekly Chart Update • Strong volume breakout recently, with price hovering around 480–490 zone • Price facing resistance near 200 EMA (red line) at ~487.70 • Support zones: – 472.55 (20 EMA) – 449.70 (50 EMA) • Weekly candle formation hints at indecision. Watch next move for breakout or fade. 🎯 Plan Ahead: If sustains above 488–490,...

🚀 Swing Setup – Alok Industries (NSE) 📍 Buy zone: ₹20.5 – ₹20.7 🛡️ Stop: ₹19.5 (₹1–₹1.2 risk) 🎯 Target-1: ₹22 — book part or trail ⚡ Breakout trigger: daily close > ₹21 on strong volume → aim for ₹23–24 💡 Risk: ~5% per share (₹1 on ₹20 = 5% risk) — position sizing is key. 🔑 Why it’s on radar • Price pressing against the recent highs, showing signs of bullish...

🚀 Swing Setup: Amber Enterprises (NSE) 📍 Buy zone: ₹ 6,620 – 6,700 🛡️ Stop: ₹ 6,420 (≈ ₹ 200 risk) 🎯 Target-1: ₹ 7,100 — book part or trail ⚡ Breakout trigger: daily close > ₹ 6,750 on strong volume → ride toward ₹ 7,500-7,600 Why it’s on the radar • Price recently reclaimed the 20- & 50-DMA, indicating solid support at ₹ 6,420–6,500. • Big volume spike on the...

📍 Buy zone: ₹ 40 – 41 🛡️ Stop: ₹ 38 (≈ ₹ 2 risk) 🎯 Target-1: ₹ 45 — book part or trail ⚡ Breakout trigger: daily close > ₹ 42 on strong volume → ride toward ₹ 48-50 Why it’s on the radar • Price is consolidating near support, holding above the 20-DMA with a potential reversal setup. • Recent weekly candles hint at accumulation as price is testing key levels,...

📍 Buy zone: ₹ 63 – 65 🛡️ Stop: ₹ 59.5 (≈ ₹ 4.5 risk) 🎯 Target-1: ₹ 70 — book part or trail ⚡ Breakout trigger: daily close > ₹ 67 on strong volume → ride toward ₹ 72-76 Why it’s on the radar • Price reclaimed the 50- & 200-DMA stack (₹ 60-61) and is now coiling just under the 20-DMA — classic squeeze setup. • Recent higher low and uptick in buying volume hint at...

📍 Entry: ₹2,915–₹2,945 🎯 Target: ₹3,250 → ₹3,300 → ₹3,740 ❌ SL: ₹2,860 ⚡ Trigger: Close above ₹3,050 with 1.5x volume Exit below ₹2,880 or if no move in 8 sessions 🧠 Reason: – Classic coil under round number ₹3,000 – Strong reclaim of all short-term MAs – Clean trend continuation structure forming 📊 Strategy: Swing | Breakout | ATH Hunt

📍 Buy zone: ₹ 413 🛡️ Stop: ₹ 406 (₹ 7 risk) 🎯 Target-1: ₹ 425 — book part or trail ⚡ Breakout trigger: daily close > ₹ 426 on strong volume → ride toward ₹ 448-455 Why it’s on the radar • Price is coiling inside short-term moving averages—compression often leads to expansion. • Tight stop just below the 20-DMA and Monday’s low keeps risk tiny while reward stays...

Power Grid Corporation is on the radar with a technical setup hinting at potential gains. **Key Highlights:** - **Moving Averages**: The stock is moving towards a bullish alignment with short-term averages (red and blue) closing in on the long-term average (orange). - **Support Level**: Key support hovers around 292, providing a solid base. - **Trade Metrics**: ...

Tata Communications is showing promising signs of recovery from its previous downtrend. **Key Highlights:** - **Trend Reversal**: Recent upward momentum hints at a potential reversal. The price is now climbing above key moving averages. - **Moving Averages**: Short-term averages (red and blue) have crossed above the long-term average (orange), indicating growing...

Bank of Baroda (BOB) is displaying encouraging technical signals that suggest a bullish trend could be underway. **Key Observations:** - **Trend Shift**: Recent price movements indicate a reversal, with moving averages showing bullish alignment. - **Moving Averages**: Short-term averages (red and blue) are crossing above the long-term average (orange), a...

Trend: Uptrend evident with higher highs/lows. Support Level: Strong support at 1,850-1,860. Moving Averages: Short-term above long-term, confirming bullish trend. Trade Setup: Target: 50.50 (2.72% profit) Stop Loss: 23.00 (1.24% loss) Risk/Reward Ratio: 2.2 Key Takeaway: Positive momentum with strategic risk management potential. Keep an eye on volatility...